Do you want to transfer wealth to other family members without dire tax consequences? One of the easiest ways to do it, and one of the most effective, is to simply give lifetime gifts to other family members.

If you stay within the tax law boundaries, these lifetime gifts will qualify for the annual gift tax exclusion. And even if you exceed the limits, the remainder is usually covered by the unified estate and gift tax exemption.

More details: The annual gift tax exclusion allows you to gift up to a specified amount to each recipient each year without any gift tax liability. The exclusion, which is indexed annually (but only in $1,000 increments), is $18,000 in 2024 (up from $17,000 in 2023). The tax treatment is automatic—you don‘t even have to file a gift tax return.

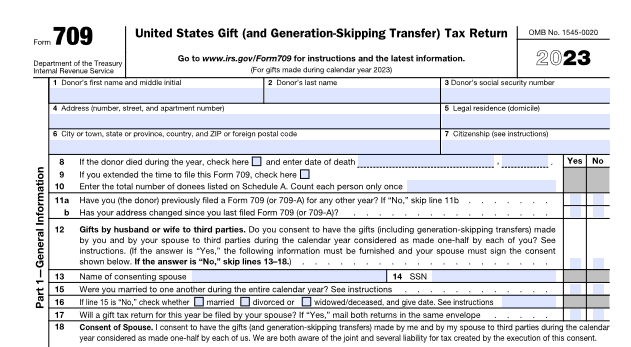

Even better, the annual exclusion is doubled for joint gifts made by a married couple or when one spouse consents to a gift by the other one. For instance, a couple could give a child or grandchild up to $36,000 free of gift tax in 2024. The caveat: A gift tax return is required for joint gifts.

If the amount of a lifetime gift exceeds the annual gift tax exclusion, the carryover is sheltered by the unified estate and gift tax exemption. For 2024, the exemption effectively shelters up to $13.61 million from tax (up from $12.92 million in 2023). Using the exemption for lifetime gifts erodes the tax shelter available for your estate, but most individuals still have plenty of room to spare. Note: The exclusion is scheduled to revert to $5 million (plus inflation indexing) after 2025,

If you give gifts of appreciated property, the value for gift tax purposes is based on your adjusted basis (often your initial cost). However, if you give gifts that have decline in value, gift tax liability is based on the value of the date of the gift. This may affect gift-giving strategies.

Typically, you should gift low-basis property that is appreciating in value. When the property is sold, it will be taxable to the recipient in their low tax bracket instead of your high bracket. On the other hand, you might hold high-basis property that is declining in value. That will provide a valuable tax loss you can claim when you sell the property. The loss can offset capital gains plus up to $3,000 of ordinary income.

For example say you acquired stock for $25,000 that is now worth $15,000. If you give the stock to another family member, their basis will be $10,000. If they sell it for $14,000, they only have a $1,000 loss of limited tax value. Alternatively, if you sell the stock yourself, you realize a $10,000 capital loss. Then you can give the relative $15,000 in cash, so they’re no worse off than before.

Of course, taxes aren’t the be-all and end-all. Just keep these tax rules in mind when you make lifetime gifts to family members.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs